Not using a cell phone for business.

August 25, 2017Исламские Счета Счета без Свопов Swap free

August 26, 2020credit unions I closed my CU checking savings accounts Weeks later the bank auto-paid my rent. Now they want me to pay them back Personal Finance & Money Stack Exchange

Checks you deposit must be payable to you or to the living trust (in the case of a trust account). Connecting accounts – If you have more than one eligible Capital One account, we will automatically “connect” your eligible accounts so they appear when you‘re logged into your account through the website or mobile app. Your 360 Checking account won‘t be considered “opened” until it‘s funded. If you have an existing Overdraft Line of Credit linked to an existing 360 Checking account, you can link it to your new 360 Checking account, but you will be unable to access it until you fund the new 360 Checking account.

For example, you can opt out of debit card and ATM overdraft coverage so that your card simply gets declined if you don’t have enough funds. Or you can link your checking account to a savings account that can cover the difference if you come up short. To close your account without any hurdles, you need to follow the guidelines set by your bank. You’ll also need to set up direct paycheck deposits and switch automatic payments from your old account to the new one to avoid overdrafts or missing a bill. Most importantly, remember to request a written confirmation from your bank as proof your account is closed permanently.

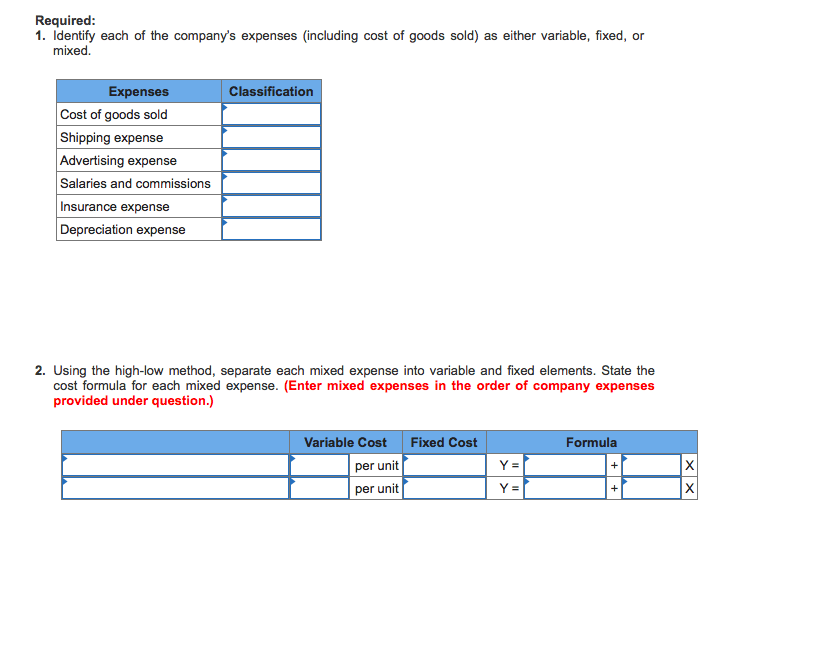

How to make a financial plan in 11 steps

At the earliest, new accounts will be able to access the service in the third calendar month after the account was opened. If we are not going to make all of the funds from your deposit available to you as described above, we will notify you at the time you make your deposit. If your deposit is not made directly to one of our Accidentally Charged Closed Bank Account employees, or if we decide to take this action after you have left our Capital One location, we will send you a notice. Change/waiver of terms – We may change the Agreement, add new provisions and/or delete provisions at any time. Changes and new provisions will be binding upon you and your account as of their effective date.

If we credit your account with funds while investigating an error, you must repay those funds to us if we conclude that no error has occurred. A refund can fail if the customer’s bank or card issuer can’t process it. For example, a closed bank account or a problem with the card can cause a refund to fail. When this happens, the bank returns the refunded amount to us and we add it back to your Stripe account balance. You can also get a negative balance from an ATM transaction, electronic payments (including automatic or scheduled payments), taking out money at a bank branch or using a debit card, among other reasons.

Legal disclaimer

We will not be liable to you for refusing a deposit, even if it causes us to decline any transactions you have already made. If you have enrolled in one of our overdraft protection services, this may result in a transfer. During your life, the funds in the account belong to you and, until your death, or if there are co-owners, upon the death of the last co-owner, the beneficiary(ies) have no interest in the account and cannot perform transactions on the account.

After paying off an old bank account balance, you can also request to have the record removed from your ChexSystems report. There are many reasons why a bank may close your account, including fraud, inactivity or too many overdrafts. When a bank closes an account, it sends a notice in the mail detailing the reason for closure and what actions you must take to have the account reopened.

Check if you have any automatic payments that are about to go through so you can halt them before they overdraw the account again. Checks are being handled in some new ways these days and those changes can affect how you handle your money. Explore the world and earn premium rewards with Chase Sapphire Reserve® or Chase Sapphire Preferred®. If you deny a customer a refund for any reason, there are two avenues that customer might take.

The most straightforward thing to do when you want to close your bank account is to go to your nearest branch and talk to a representative. If you’ve usually received cancelled checks with your bank statement, you could start receiving substitute checks—the special paper copies created under the Check 21 Act—instead of, or in addition to, cancelled checks. Check processing involves several parties-you, the person you’re paying, that person’s bank, and your bank.

What if I made the payment another way?

This starts with enrolling the merchant in a remediation program, but the consequences can escalate swiftly, ending in termination of the merchant account. For example, it used to be standard practice in e-commerce for the customer to pay the return shipping on a product they want to return, but these days customers expect the merchant to pay for that as well. Customers are always happiest when the money never leaves their account, especially in the case of a transaction made in error. A separate refund transaction means the money might not be made available to them right away. Each type of payment reversal has its own rules, restrictions, and costs.

Bank of Ireland IT Blunder Allows Customers To Withdraw More … – Slashdot

Bank of Ireland IT Blunder Allows Customers To Withdraw More ….

Posted: Wed, 16 Aug 2023 01:30:00 GMT [source]

You would, however, need to deposit at least $250 in May for us to consider paying overdrafts in June. When deciding to pay transactions that cause an overdraft, we consider a variety of factors, including the amount of the transaction and/or your history with us, including whether you’ve previously had too many overdrafts on your account(s). Enrolling in No-Fee Overdraft authorizes us to consider paying transactions that would overdraw your account.

Cash back cards

Bill Pay and other account features are provided “as is” without warranty of any kind, either expressed or implied, including, but not limited to, the implied warranties of merchantability and fitness for a particular purpose. Refer to the Electronic Fund Transfer Disclosure Statement for information regarding electronic fund transfer stop payment requests. Please remember that you can only make payments to Billers with mailing addresses in one of the 50 United States or with military addresses (APO or FPO). Please understand that Billers and/or the US Postal Service may return payments to us for various reasons such as expired addresses, invalid account numbers, the inability of the Biller to locate your account; or your account being paid in full.

When a deposit is made to your account, the funds may not be available immediately. For example, if you deposit a check on Monday, you may not be able to withdraw the funds from that check, and we may not pay another check with those funds, until Tuesday or even later. Our general policy is to make funds from your check deposits available to you on the first business day after we receive the deposits. Cash and electronic direct deposits will be available on the day we receive the deposit. Longer delays may apply (as described below), and different rules apply for checks deposited from customers with accounts open fewer than 30 calendar days. Your account won’t be considered “opened” until you have made a deposit to the account.

You can also transfer money at a Capital One ATM terminal between any accounts that are linked to your Card. We may limit, refuse or return any withdrawal or transfer of funds from your account that is made in a manner not permitted by us. For other payment methods, like ACH and iDEAL, refund handling varies from bank to bank. If a customer has closed their method of payment, the bank might return the refund to us—at which point it’s marked as failed. Keep in mind that state laws typically prohibit writing bad checks or purposefully bouncing payments. If you’re aware that your account is negative and you try to make a payment from that account knowing it won’t go through, you could be charged with a crime in some circumstances.

After finding a new bank or credit union and opening an account, check if they offer a switch kit. Even if you do not usually receive cancelled checks, you may ask your bank to provide you with copies of specific original checks, or the cancelled checks themselves. When a paper check is processed electronically, the original check is typically destroyed.

If your direct deposits are already sent to your Capital One 360 Checking account, you do not need to take any additional action. Earlier availability of direct deposits is dependent on the timing of your payor’s payment instructions, fraud prevention overlays, and other restrictions, such as limits on the amount and frequency of direct deposits to your account. These limits are designed to be flexible in order to protect the security and integrity of the service and accounts.

- If you have an existing Overdraft Line of Credit linked to an existing 360 Checking account, you can link it to your new 360 Checking account, but you will be unable to access it until you fund the new 360 Checking account.

- Your bank might offer overdraft protection programs that can help you avoid negative balances.

- Now that many checks are being processed electronically, money may be taken out of your account more quickly.

- Events beyond our control – We’ll make all reasonable efforts to give you access to your accounts and current and complete account information.

- When you see the words “you” and “your,” they mean each person who owns an account or each trustee who is legally entitled to manage an account.

In general, these perks are well known, but there are other aspects to credit cards that are not widely understood. One of these aspects is credit card account closures, particularly why they happen and if they can be reopened. The notice should tell you how to rectify your account and what happens if you fail to repay it.

Using an updated version will help protect your accounts and provide a better experience. But life happens and there may be times when your balance does, in fact, go into the red. There are several things you can and should do when you’ve overdrawn on your account. Determining what makes for a generous refund policy depends on the market you’re in, the kind of products you sell, and general industry trends. In recent years, the trend in e-commerce has been to entice customers with easy, flexible, no-questions-asked return policies.

We will notify you if we delay your ability to withdraw funds for any of these reasons, and we will tell you when the funds will be available. Your 360 Checking Agreement, Overdraft Line of Credit Agreement and other agreements you may have with us contain other exceptions to the Bank’s liability. You agree that we don‘t have any responsibility or liability for any act or omission beyond that which is imposed on us by law. The Service is currently being provided as a “pilot” or experimental version intended only for testing purposes. The pilot is being done to provide us with feedback on the quality and usability of the Service. There are some features that are not available in the pilot but may be made available in the future.

By enrolling in the Service, you agree that the Servicer may request a review of your credit file and/or credit report, through the use of a consumer reporting agency. In order to resolve payment-posting issues, you authorize the Servicer to gather any and all reasonably necessary financial information from your Biller(s) or financial institution(s) regarding your payment(s). You may schedule a preauthorized recurring bill payment transaction using the Service. By doing so, you authorize Our Service Provider to electronically debit your designated payment method to pay a specific Biller on a recurring basis (for example, weekly, monthly or annually) each month for a particular bill payment. As applicable, You also authorize the Service Provider to electronically debit and credit your designated payment method to correct erroneous debits and credits.

Right calls for new military campaign as IDF searches for Huwara … – The Jerusalem Post

Right calls for new military campaign as IDF searches for Huwara ….

Posted: Sun, 20 Aug 2023 12:35:00 GMT [source]

You can’t get in trouble for overdrawing your account but you may face fees, which could lead to financial difficulty. Your bank may close your account and may send you to collections until you repay the balance. The major card networks task their acquiring banks with monitoring chargeback-to-transaction ratios and establishing thresholds for “excessive” chargeback activity, often no higher than 1%. They do this to prevent fraudulent and reckless merchants from abusing the system and causing consumers to lose confidence in the safety of payment card transactions. Opinions expressed here are author’s alone, not those of any bank, credit card issuer or other company, and have not been reviewed, approved or otherwise endorsed by any of these entities.